Insights from: Konstantin Boehmer and John Cook

If the world is going to transition to a low-carbon economy, it will require significant investments on both sides of the asset class aisle. Whether buying bonds or owning shares in companies, investors must consider all their options when investing in the energy transition, which is expected to become a US$4.5 trillion-a-year opportunity by 20301.

The massive investments needed to reduce carbon emissions are creating even more opportunities in what’s been a rewarding part of the market, say two Mackenzie Investment portfolio managers who have been involved in the energy transition area for more than a decade. “Fundamentally, growth continues in our space,” says John Cook, Senior Vice President, Portfolio Manager and Co-Lead of Mackenzie’s Greenchip Team.

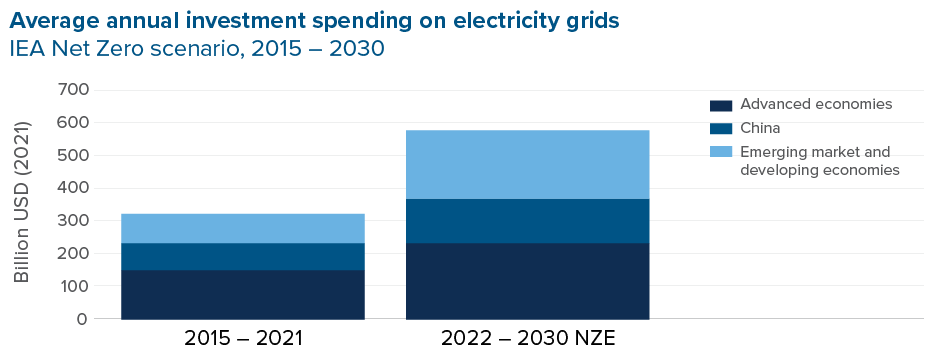

For instance, investments in the electricity grid reached US$300 billion last year, and that’s expected to at least double over the next decade2. Demand for solar is increasing, agriculture is at the bottom of its cycle, with nutrient prices now expected to rise, and while electric vehicle sales may not be growing as quickly as they have in the past, sales are still increasing in Europe and China. “There’s some real opportunities in all the noise,” he says.

Within fixed income, Konstantin Boehmer, a Portfolio Manager and Head of Fixed Income at Mackenzie, says there’s plenty of opportunity in sustainable bonds. In 2023, companies issued US$1.34 trillion of sustainable fixed income – more than the entire US high-yield market – and that was even slightly below 2022’s record-breaking year3.

Interest has climbed partly thanks to the now broader appeal of bonds, but the biggest investment in the energy transition could come from fixed income. “That’s usually where money is being raised,” he explains, adding that the many mega projects that must get built will have to get financed through fixed income.

More capital needed for the transition

One of the challenges, Cook believes, is that much of the capital that’s needed to fund the energy transition, particularly on the equity side, is getting deployed into promising but unproven technologies, such as artificial intelligence (AI).

According to the Economist, the market cap of the top 100 listed AI companies cumulatively added US$8 trillion in market cap over the past year. That’s a larger market cap than the global airlines, pharmaceuticals and automobile industries combined. “We just added US$8 trillion to the market cap of a technology that we don’t really know what it’s going to do yet and doesn’t have a clear business model,” says Cook.

With savings flowing towards high momentum technology stocks, prices for equity in the companies that could impact the energy transition are lower than they should be given their fundamentals, Cook explains. “That puts them in a position where if they’re a growth business, they can’t raise new equity to invest more themselves,” he says.

In Boehmer’s view, the environment is better on the fixed income side, saying the market is wide open for any good company that wants to issue debt. “Money is available to finance the transition,” he says.

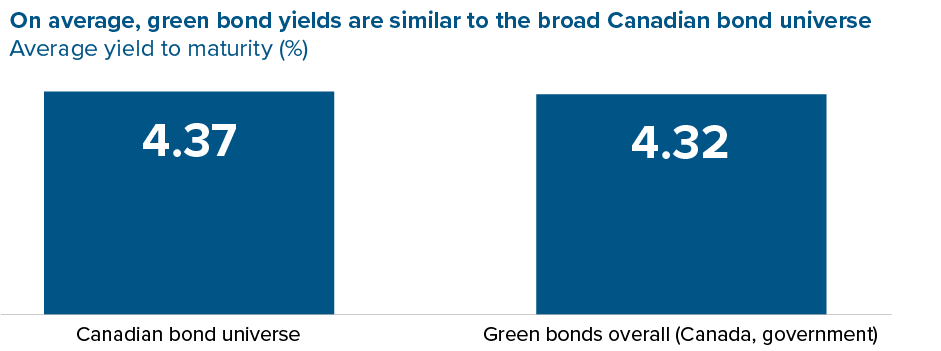

As well, there’s no longer a meaningful “greenium” – when green bond yields are lower than traditional bond yield – which suggests there’s no disadvantage to buying sustainable fixed income. “You’re doing something good when you buy sustainable fixed income – that money is going into projects that are needed and required,” he says. “But at the same time, performance is very comparable.”

Opportunities in traditional investments

Whether it’s equities or fixed income, building a more sustainable future requires “investment in traditional industrials, materials, and utilities,” argues Cook. That means investments in more physical, rather than digital, kinds of businesses.

For instance, there aren’t enough copper mines being developed – some have been shut down due to geopolitical issues, but mostly investors don’t have the time horizons required to support them – which will result in the world having about half the copper it needs to support the electrification of the economy a decade from now.

Although trillions have already been invested in renewable energy projects, some projects still can’t connect to the grid because enough hasn’t been invested in building it out, says Cook. The lack of capacity will only get worse as more data centres, heat pumps and electric vehicles get introduced to the grid.

“Investing in the electric grid, power equipment and electric metals is absolutely essential for us to bring inflation down,” says Cook. “It will enable us to build an economy that we can grow our children’s futures in a more sustainable way.”

Sources

1 International Energy Agency, net zero roadmap, 2023

2 IEA (International Energy Agency), September 2022

3 Bloomberg, December 2023

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. The content of this article (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavor to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.

Paid Advertisement. The following is a paid advertisement and represents the views of its author on behalf of Mackenzie Financial Corporation.