As we approach year-end, many advisors look for opportunities to implement tax loss strategies in their client’s portfolios. It might seem counterintuitive to think about losses in 2024, when both equities and fixed income posted stronger than average returns (at least, as we write this on November 18, 2024), fueled by softening inflation, economic resilience and monetary policies easing.

However, investors should look at the adjusted cost base of their securities to identify if there are any capital losses that could be crystallized before year-end.

As a reminder, tax loss harvesting involves an investor realizing losses by selling securities that currently have a fair market value that is lower than its adjusted cost base. This strategy applies only to non-registered accounts and the realized losses may be used to offset other gains in a portfolio, ultimately lowering the tax payable in the year.

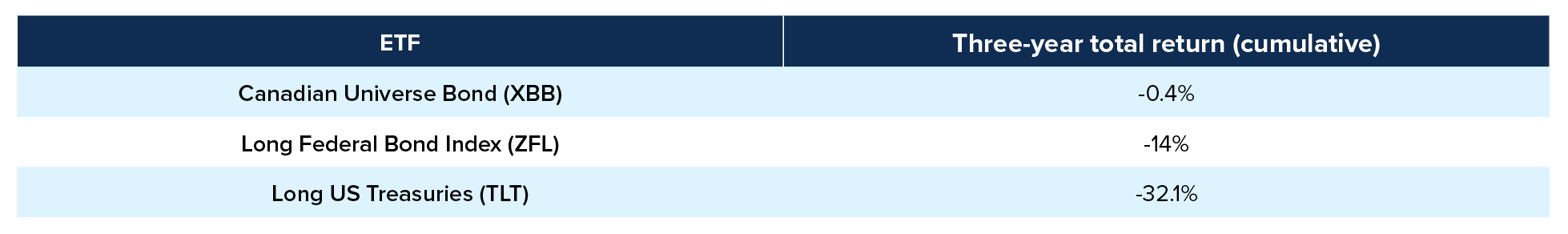

Let’s look at three fixed income ETFs, replicating three different asset classes in positive territory over a three-year period.

Source: Bloomberg, Returns as of November 15, 2024

Source: Bloomberg, Returns as of November 15, 2024

Are these the losses?

Returns presented above are total returns including distributions, and assuming reinvestment.

Certain distributions are taxed in the year they are received, so if you held these ETFs in a non-registered account, each year you would have to include these amounts in your income for tax reporting, regardless of whether the distribution was paid in cash or reinvested.

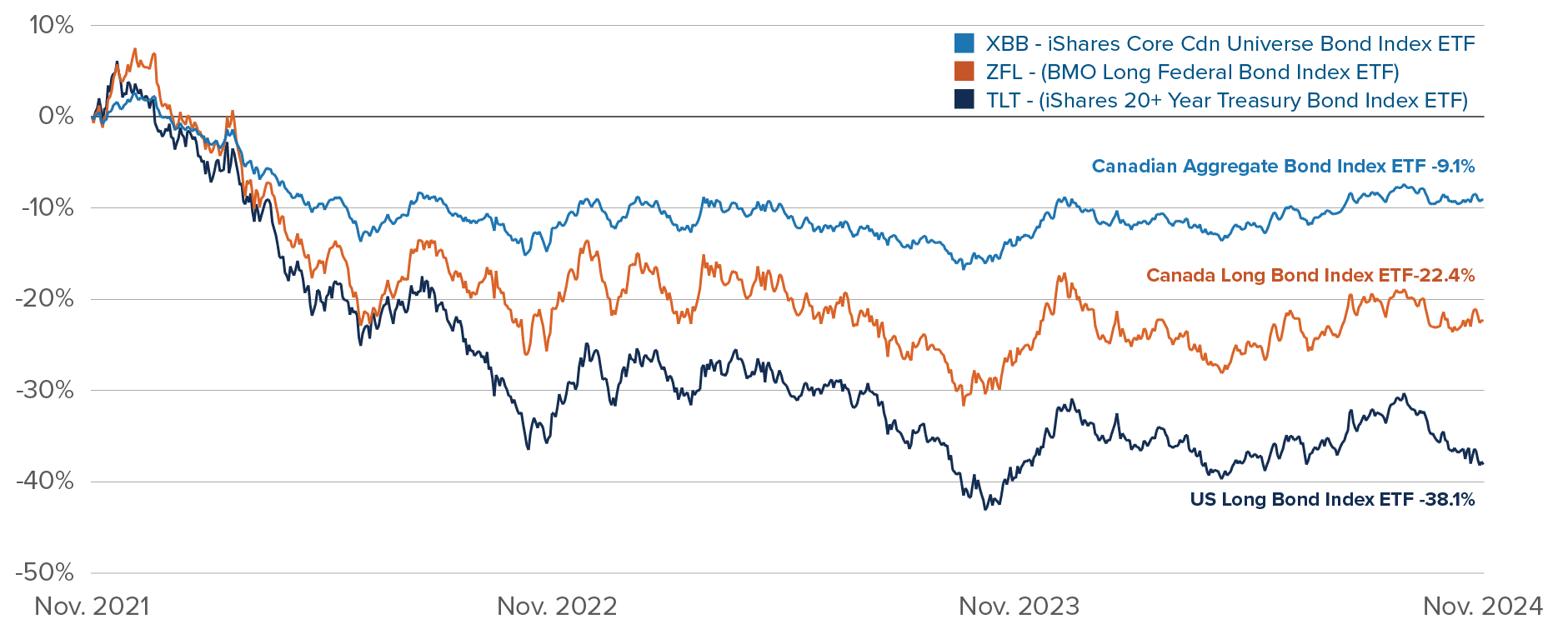

While bonds have provided positive total returns in 2024, clients who’ve held bond funds and/or ETFs for longer periods may still have capital losses. As shown in the chart below, Canadian aggregate bond ETFs are still down over 9% over the last three years, while Canadian and US long-term bond ETFs are down roughly 22% and 38% respectively (all on a price basis).

In the case of XBB for example, Table 1 (above) showed a total return of -0.4% while the graph below shows a price return of -9% over the past three years. In other words, the entirety of XBB returns have come from distributions, most of which would likely have been taxed already.

Fixed Income ETF Tax Loss Harvesting Opportunities Three Year Cumulative Price return (Period: 2021-11-15 to 2024-11-15)

Source: Bloomberg; as of November 15, 2024

Source: Bloomberg; as of November 15, 2024

The same reasoning would apply with high dividend paying ETFs, Funds or individual stocks such as BCE.

BCE illustration:

Once losses have been identified and the decision has been made to take advantage of the tax loss opportunity, there are still two things to determine:

- How to avoid running afoul of the superficial loss rule under Canadian tax law; and

- How to redeploy the proceeds of the sale and how to minimize the potential impact on the rest of the portfolio, assuming the allocation is still relevant and to be conserved.

Generally, when an investment is sold at a loss, and an identical investment is purchased either 30 days before or after the loss was realized, the superficial loss rules will apply so that you cannot claim the loss. Instead, the loss is added to the adjusted cost base of the identical property acquired. For more nuances and a full description of the rules, please refer to ‘Superficial loss - Canada.ca’.

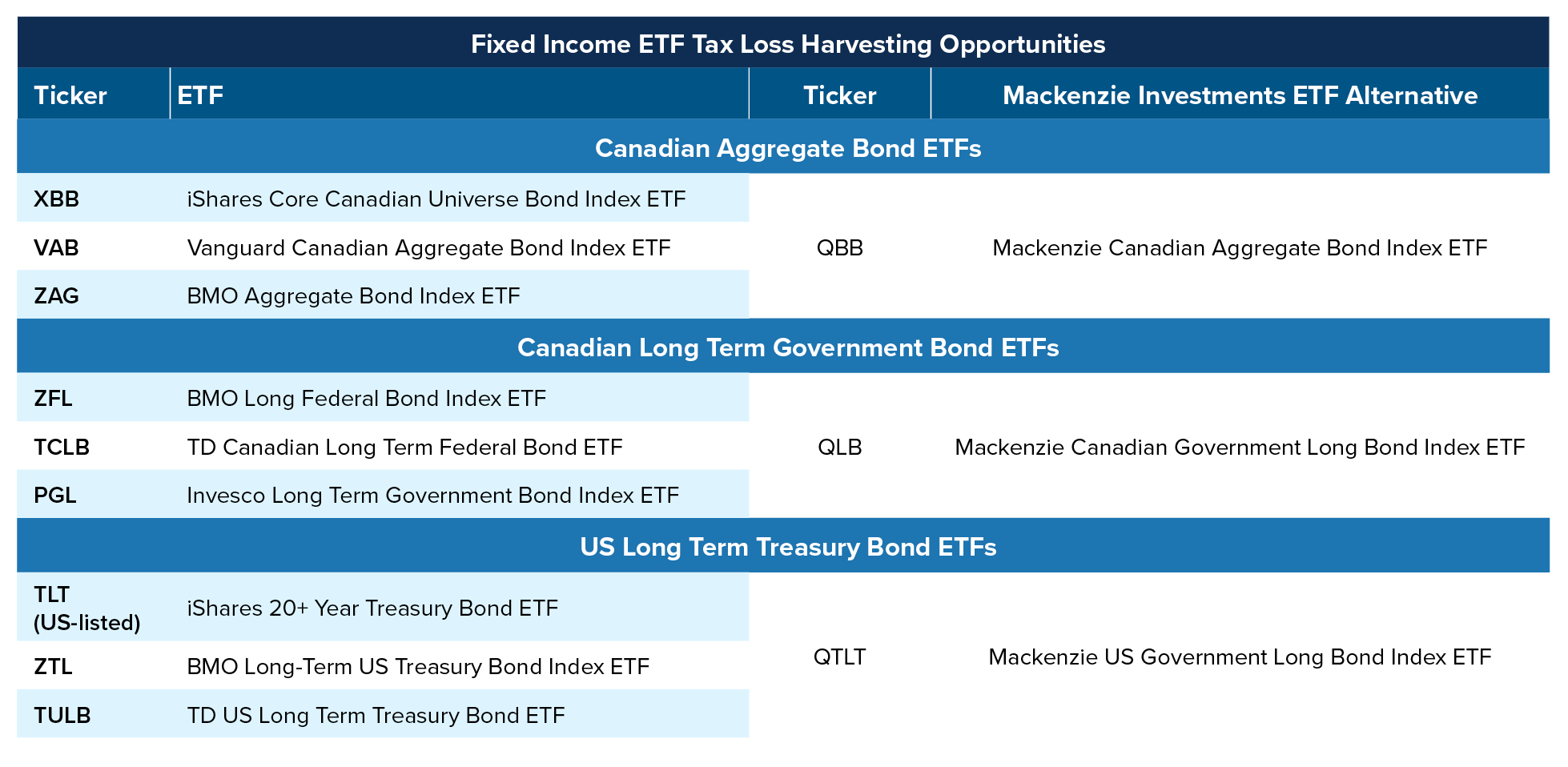

To remain onside with the superficial loss rules, investors can usually add a similar but not identical investment in their portfolio. As one example, an ETF can typically be purchased with similar exposure as another ETF, provided it tracks a different index. For instance, many core Canadian fixed income index ETFs track the FTSE Canada Universe Bond Index. If an investor held this position and it was currently at a loss, they may be able to sell this ETF and purchase a similar ETF, such as Mackenzie Canadian Aggregate Bond Index ETF (QBB).

Since QBB tracks the Solactive Canadian Float Adjusted Universe Bond Index, which employs a different methodology to provide exposure to the Canadian bond universe, units of the QBB should not be identical property under the superficial loss rules. Alternatively, you can use this opportunity to reorient your fixed income allocation by either moving to a broader, actively managed strategy or tilting the allocation to better align with future market conditions (for example, moving to higher duration to capitalize on lower rates).

Example tax loss selling opportunity – Canadian and US bonds

For several fixed income ETFs and alternatives offered by Mackenzie Investments, see below:

Other tax loss harvesting opportunities

Major equity indices have largely posted stellar returns in 2024, with US and Canadian broad market equity indices up +28% and +17.9% year-to-date (in CAD). However, many widely held Canadian and US stocks are down, even this year. If several stocks are down in the portfolio, an investor could explore selling these stocks and reinvesting these funds in an ETF – rather than trying to find direct replacements for each name.

Trade idea: sell out of individual Canadian equities that are down and invest in Canadian equity ETFs.

Source: Bloomberg; as of November 15, 2024

Source: Bloomberg; as of November 15, 2024

For a full list of potential tax loss harvesting opportunities in 2024 and where ETFs may be able to help, please reach out to your Mackenzie wholesaling team.

Commissions, management fees, brokerage fees and expenses may all be associated with Exchange Traded Funds. Please read the prospectus before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all distributions, and do not take into account sales, redemption, distribution, or optional charges or income taxes payable by any security holder that would have reduced returns. Exchange Traded Funds are not guaranteed, their values change frequently, and past performance may not be repeated.

Index performance does not include the impact of fees, commissions, and expenses that would be payable by investors in the investment products that seek to track an index.

The content of this article (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.

This article should not be construed as legal, tax or accounting advice. This material has been prepared for information purposes only. Any tax information provided in this document is general in nature and each client should consult with their own tax advisor, accountant and lawyer before pursuing any strategy described herein as each client’s individual circumstances are unique. We have endeavored to ensure the accuracy of the information provided at the time that it was written, however, should the information in this document be incorrect or incomplete or should the law or its interpretation change after the date of this document, the advice provided may be incorrect or inappropriate. There should be no expectation that the information will be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise. We are not responsible for errors contained in this document or to anyone who relies on the information contained in this document. Please consult your own legal and tax advisor.

This article may contain forward-looking information which reflect our or third-party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of November 18, 2024. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise.